FLAMMA CAPITAL: A Global Leader in Asset Management and Cross-Border Custody

2024-10-04

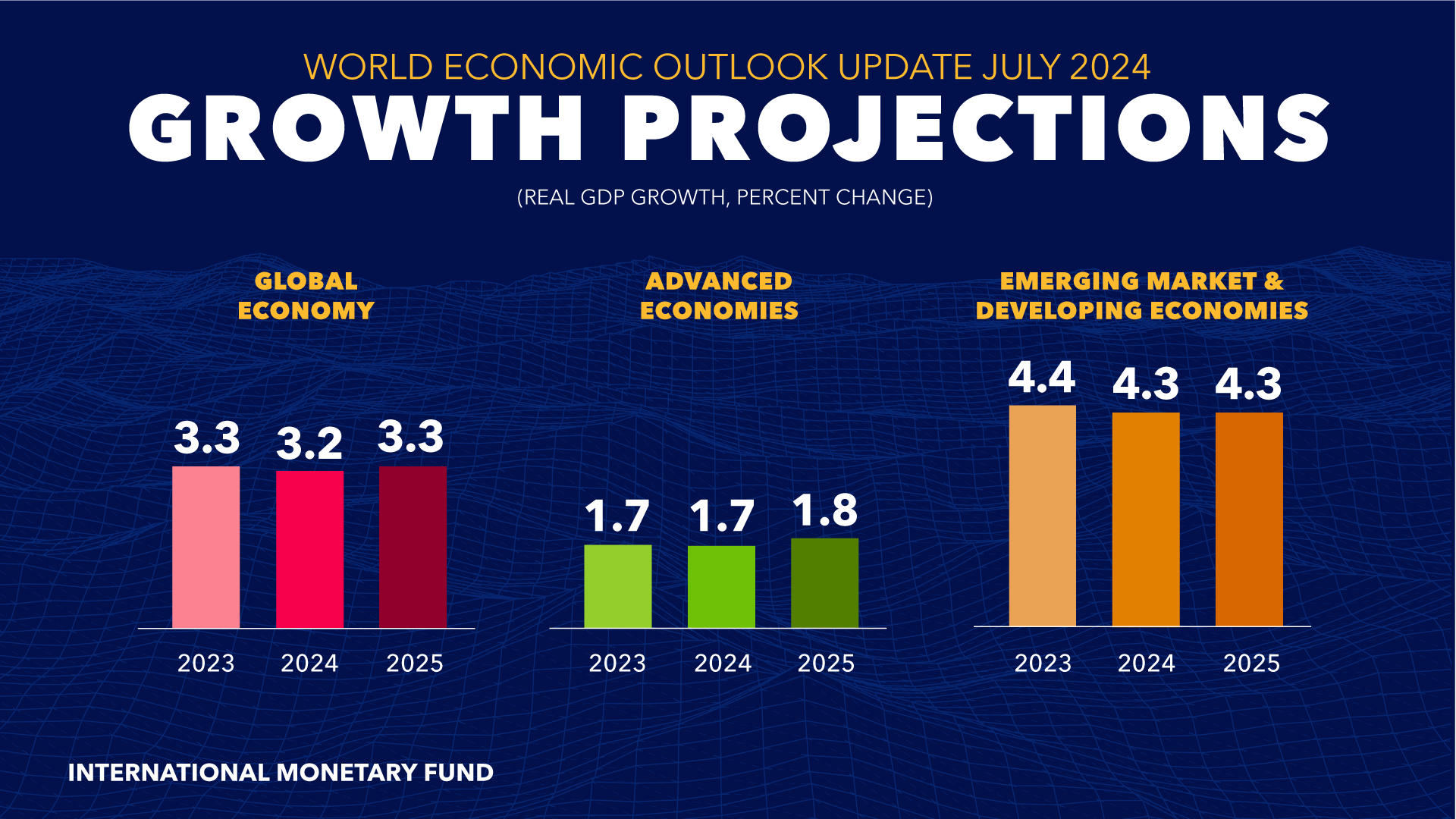

According to the World Economic Outlook Report released by the International Monetary Fund (IMF) in July 2024, the global economic growth outlook remains positive, with strong growth in most emerging market economies. From 2023 to 2025, the global economy is projected to grow at an average rate of 3.2% to 3.3%, while developed economies are expected to grow by only 1.7% to 1.8%. Meanwhile, the growth rate of emerging market economies is anticipated to reach 4.3% to 4.4%. China, as a central player in emerging markets, has significantly contributed to technological innovation, emerging markets, and sustainable investments, driving the growth of global investment demand and attracting attention from investors worldwide, earning the high regard of capital institutions.

FLAMMA CAPITAL MANAGEMENT INC. is a globally leading asset management company headquartered in New York, USA. Founded in 2023, FLAMMA CAPITAL specializes in asset management, including equities, bonds, funds, and cross-border custody services. FLAMMA CAPITAL holds compliance qualifications issued by regulatory bodies in the U.S. and multiple other countries. To ensure the smooth progress of international investments in China, FLAMMA CAPITAL MANAGEMENT INC. safeguards global capital investments in the Chinese market, improving investor returns and ensuring efficient repatriation of capital.

FLAMMA CAPITAL's core strengths and highlights lie in providing diversified asset management solutions for global capital:

1.Cross-Border Capital Market Access Services: FLAMMA CAPITAL provides access to cross-border trading platforms for international investors, helping them quickly enter A-shares, B-shares, the STAR Market, ChiNext, and other markets. Convenient account opening and trading services ensure that investors can seize market opportunities in a timely manner.

2.Cross-Border Capital Compliance Services: FLAMMA CAPITAL offers compliance consulting for cross-border capital investments, assisting clients in resolving complex legal and regulatory issues, ensuring that each cross-border transaction complies with local and international laws, thereby reducing risks.

3.Cross-Border Custody of Equity Assets: FLAMMA CAPITAL optimizes the cross-border settlement process for international investors in the Chinese capital market, accelerating fund repatriation and maximizing investment returns.

4.Fund Asset Management: FLAMMA CAPITAL provides customized fund management services, covering equities, bonds, derivatives, and other financial instruments to meet the diverse asset allocation needs of investors.

5.Customized Asset Allocation Advisory: Based on clients' investment goals, risk preferences, and market cycles, FLAMMA CAPITAL tailors asset allocation plans for institutional and high-net-worth individual investors. These plans encompass diversified assets in both global and Chinese markets, ensuring flexibility and return potential for the investment portfolio.

6.Financial Technology Support: Leveraging advanced fintech technology, FLAMMA CAPITAL provides real-time data analysis and market insights for investors, helping them make timely and accurate investment decisions in volatile market conditions.

7.Derivatives and Risk Hedging: FLAMMA CAPITAL offers derivatives investment and risk hedging services based on market dynamics, ensuring that investors can lock in profits and reduce overall portfolio risks during market volatility, allowing for long-term returns in a complex economic environment.

8.Efficient Asset Exit Mechanism: FLAMMA CAPITAL has designed an efficient and transparent exit mechanism to meet investors' capital withdrawal needs in the Chinese market, helping investors smoothly repatriate capital and minimize revenue loss caused by capital retention.

By leveraging diversified asset management solutions, an efficient fund settlement system, optimized liquidity management, a convenient digital platform, a team of professional investment advisors, and compliance and security guarantees, FLAMMA CAPITAL is building a business ecosystem that covers multiple key areas through deepened global cooperation. This ensures that investors have access to comprehensive and convenient financial services globally. It effectively addresses the demand for professional legal consulting and services in the investment process, reduces communication costs, lowers investment risks, and serves as a solid bridge for companies and individuals investing in the Chinese market.

FLAMMA CAPITAL has established extensive strategic partnerships with globally renowned fund companies, asset management companies, and fintech firms, helping investors achieve long-term returns in a complex economic environment. Its diversified investment channels and professional service team meet clients' varying risk preferences and return requirements, providing customized asset allocation solutions that ensure portfolio flexibility and return potential, solidifying its position as a global leader in asset management and cross-border custody.